Paper Trading Explained

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

Paper trading allows investors and traders to practice placing trades, test trading ideas, and evaluate trading platforms without risking money.

Before the advent of online trading, paper trading meant painstakingly tracking your buy and sell orders by hand—using pen and paper (thus the name) or a spreadsheet—and then crunching the numbers. Nowadays, paper trading occurs in simulated (aka "sim") trading environments within online trading platforms, so you can easily get comfortable with the platform's features and workflow.

Here's a quick explainer on paper trading: what it is, what it tells you, and the pros and cons to consider.

A sim trading interface can look, feel, and function much like a live trading platform, complete with a sim account balance that goes up and down as you close out positions at a profit or loss. Because paper trading uses a sim account balance and not real cash, you can't make or lose any money, making it a risk-free way to hone your trading skills.

Some trading platforms, such as TradeStation, have advanced sim trading environments where you can place sim trades using real-time market data, accounting for slippage and commissions to provide the most realistic experience possible. You can also back test, optimize, and forward test your trading ideas to see what works (and what doesn't) while becoming familiar with the platform's features.

At the other end of the spectrum are trading platforms that offer paper trading with limited functionality. Few research and technical analysis tools may be available, and you might be restricted to the platform's basic order entry interface (platforms often have multiple ways to place trades). Still, it can be a helpful way for beginners to practice placing basic trades and get a feel for the platform.

Paper trading can be helpful whether you're a beginner interested in learning to trade investments—e.g., a few stock shares or an exchange-traded fund(ETF)—or a more experienced investor eager to test advanced options strategies. Either way, paper trading lets you practice the mechanics of placing trades, test your trading ideas, and learn how to use the platform effectively.

While placing trades seems easy, it's not uncommon for newer traders to make costly order entry mistakes—say, clicking the “buy” button when you meant to click “sell.” Another common mistake beginners make is using the wrong order type. For instance, a limit order lets you place a buy order below the market price to improve your entry (i.e., get a better price). If you accidentally use a stop order below the market price, the order fills immediately without any price improvement (potentially a price you don't want to accept).

By testing your trading ideas, paper trading lets you validate (or negate) your strategies before risking real money. If an idea is consistently profitable during paper trading, it's more likely to succeed during live trading. Conversely, if an idea performs poorly during sim trading, it's unlikely to do well in real life.

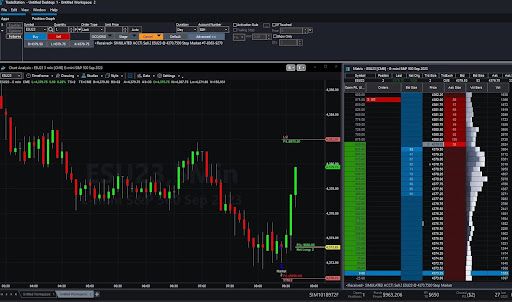

A paper trade in TradeStation showing the trade entry, profit target, and stop loss. Courtesy PowerZone Trading.

Finally, paper trading lets you test-drive a platform to discover its capabilities. Robust trading platforms can take months (or even years) to master, and paper trading enables you to learn on your timeline without risking any capital.

Keep in mind that there's no set transition from paper trading to live trading. Some traders paper trade for a few weeks, while others stick to sim trading for months (or longer) before entering a live market. Likewise, experienced traders can revisit paper trading to practice using different order types, test a new strategy, or trade a new market. Ultimately, the time you spend paper trading depends on your goals, risk tolerance, and familiarity with the markets.

Paper trading can be an excellent tool for new traders, but drawbacks exist. Here's a rundown of the pros and cons of paper trading.

Pros

Cons

Paper-trading accounts provide a risk-free and stress-free way to practice trades, test ideas, and explore a platform. With no capital at stake, you can't lose any money, even if you click the wrong order button or use an incorrect order type.

When you place trades in a live account, you risk real money, so your trading decisions have consequences. You can make money when a trade moves in your favor—or lose money if it goes against you. It's possible to lose your entire investment on a bad trade. If you take a short position (bet that prices will drop), you can lose more than your initial position because prices can theoretically climb indefinitely.

During live trading you're also on the hook for trading commissions and fees (if you're an active trader, consider choosing a broker with zero-commission online trades). These costs can erode your profits, so it's essential to consider them when evaluating a trading strategy.

Paper trading can be an excellent way for beginners to gain experience and confidence before risking real money. Importantly, paper trading can help you stay in the game while learning how (and what) to trade: If you put real money on the line before you're ready, you could damage (or zero out) your trading account balance.

Of course, traders at any level can take advantage of paper trading. For example, experienced traders may use paper trading to practice new order types, try different trading ideas, or test-drive a new trading platform.

The key is to remember that despite its benefits, paper trading has limitations. It can't replicate the stress and the emotions of live trading. Additionally, it can give you a false sense of security—in terms of profitability and your ability to manage emotions. Still, the more you practice, the better prepared you'll be to handle any mistakes or setbacks in the future.

There's no money involved in paper trading, so you can't make any money. However, the good news is that you can't lose money either. It’s a risk-free way to improve your trading game.

Many brokers offer paper trading to help new and experienced traders practice trades, test ideas, and learn the platform. Some of the most popular brokers for paper trading include:

Note that some brokers require you to open and fund an account before accessing a paper trading account.

Paper trading can be an invaluable tool for everyone from beginners to investors with decades of experience if used the right way. To get the most out of paper trading, follow these tips:

Keep in mind that self-directed trading takes significant time and effort. If you don't have the time, interest, or expertise to make your own trading decisions, consider working with a financial advisor such as WiserAdvisor or a robo-advisor such as M1 Finance.

There are two main types of stock market simulators: games and virtual trading. With stock market games, you compete against friends and strangers to build the top-ranked portfolio, often taking a buy-and-hold approach. Virtual trading is the same as paper trading: You use a sim trading platform to practice real trading, test ideas, and get used to the platform's features and tools.

Both options are an excellent way to gain experience, try new ideas, or explore new markets without risking any cash.

You can find stock simulators by searching online for "stock market simulator" or "stock market game" or browsing for apps in the Apple App Store or Google Play Store. It can be helpful to read the reviews in the app stores or research the numerous "best of" online lists to find a simulator that matches your goals and trading style. The sim platforms offered by online brokerages are generally a good pick and let you move seamlessly from sim trading to live trading.

To get started, choose a broker and follow the steps to open a sim trading account. You might have to open and fund a "real" account, or the broker may offer a demo account where you can paper trade for a limited time. It can be helpful to test-drive a few platforms to find one that suits your needs and workflow.

From there, the goals are to gain confidence with order entry, hone your trading strategy, and explore the platform. If all goes well, and your strategy shows potential, consider trading with real money in a live account. It's best to start with small positions, risking small amounts of capital before increasing trade size. That gives you a better chance of staying in the game (i.e., not losing all your money) if you make a mistake or have a bad trade.

Review and evaluate your progress regularly. Ideally, your live trading and paper trading results will be similar. If you are losing money, consider resuming paper trading for a while so you can figure out the problem. For example, you might be using the wrong order type, or your emotions may be leading to poor decisions.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.