The History of CD Rates: From 1984 to 2024

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

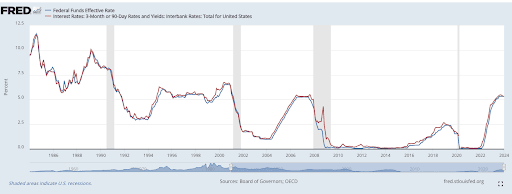

Interest rates on certificates of deposit (CDs) are influenced by the Federal Reserve funds rate. As the Fed raises its interest rate to reduce high inflation, most banks raise the interest rate paid to customers who open deposit accounts, including high-yield savings accounts, money market accounts (MMAs), and CDs.

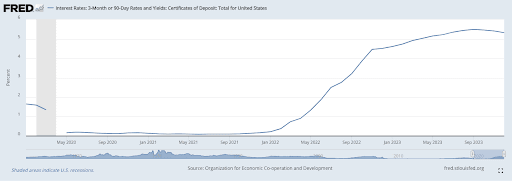

The period from 1984 to the present day featured interest rates on three-month CDs that peaked at 11.56% in July 1984, then declined to a low of 0.09% in June 2021. By December 1, 2023, rates had rebounded to more than 5%. As of February 2024, some banks and credit unions are paying as high as 5.51% annual percentage yield (APY).

Understanding the history of deposit accounts over many years can help you obtain the best CD rates, given current economic conditions. It’s also important to know how CDs function and where to buy them. Traditional CDs are savings accounts with fixed deposits and rates of return, with terms ranging from a month to several years (ex.: 6-month CDs, 1 year CDs). Banks and credit unions sell them, including brick-and-mortar institutions, such as CIT as well as online banks, including Quontic, Discover® Bank, and others.

| Title | APY* | Min. deposit | Term |

|---|---|---|---|

CIT Bank CD No Penalty | 3.50% | 1000 | 11 months |

Quontic 1 Year CD | 4.00% | $500 | 1 Year |

Discover® CDs | Up to 4.10% | None | 3 months to 10 years |

The graph below shows how closely CD rates—in this case, three-month rates—have followed the federal funds rate over time.

Source: Board of Governors of the Federal Reserve System

With this overview in mind, here's a closer look at how CD rates have shifted over time.

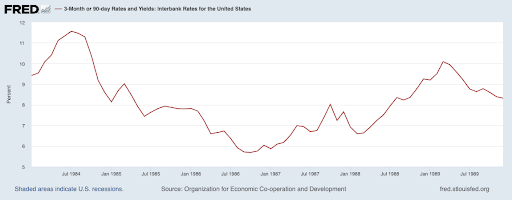

Following back-to-back recessions and previous periods of high inflation, rates on three-month CDs climbed from almost 9.5% in January 1984 to nearly 12% in July before falling to 8.6% by the end of the year. The roller-coaster ride continued for the decade's balance, with rates as low as 5.69% in 1986. All but one of the nine months during this period that featured double-digit returns occurred in 1984 (the exception being March 1989). Those who could save received some of the highest interest rates available for the next four decades. The end of the decade saw average three-month CD rates of 8.32%.

Source: Board of Governors of the Federal Reserve System

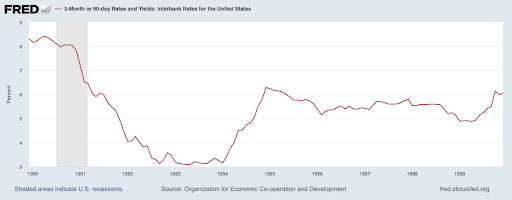

Interest rates on CDs fell in the ’90s due to lower inflation and an improving economy. The highest three-month CD rate during this decade occurred in April 1990 and paid 8.42%. However, by April 1993 the rate was just 3.09%. From then until December 1999, rates rose to 6.29% in December 1994, leveled out, and settled at 6.05% in December 1999.

Source: Board of Governors of the Federal Reserve System

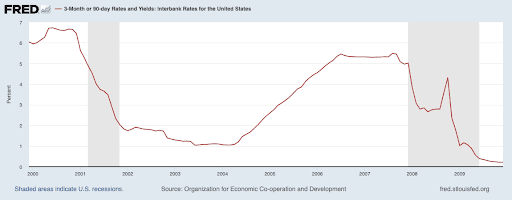

In January 2000, three-month CDs paid interest rates of 5.95%, peaking in June at 6.73%. Beginning in November 2000, following the end of the dot-com era, rates experienced a steady decline, settling at 1.04% in June 2003. In July 2006, just ahead of the Great Recession (2007 to 2009), three-month rates stood at 5.46%. By December 2009, they returned 0.22%.

Source: Board of Governors of the Federal Reserve System

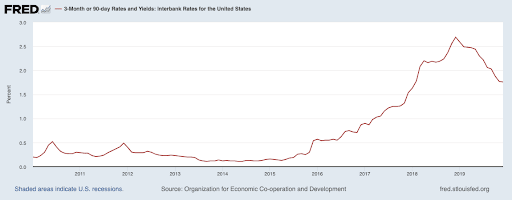

In the aftermath of the Great Recession, CD rates fell to all-time lows. January 2010 saw three-month rates averaging 0.20% APY. Rates stayed below 0.5% through November 2015. As the Fed increased its benchmark interest rate between 2015 and 2018, CD rates slowly rose. By December 2018, the average three-month CD yield had increased to 2.69%. Overall, however, the decade saw historically low CD rates.

Source: Board of Governors of the Federal Reserve System

The COVID-19 pandemic had a dramatic effect on the economy. From February 2020 through May 2020, rates on three-month CDs fell from 1.59% APY to 0.17%, where they remained mostly level through December 2021. January 2022 saw rising interest rates that resulted in a respectable 5.32% APY in December 2023. Since then, rates have remained above 5% APY with current rates hovering near or slightly above 5.5% APY.

Source: Board of Governors of the Federal Reserve System

Ultimately, CDs are more for saving than investing. A five-year term CD with a high interest rate can be a protected savings account for a future large purchase, such as a car or house. A guaranteed interest rate, Federal Deposit Insurance Corporation (FDIC) insurance—and the disincentive to take the money out to avoid early withdrawal penalties—make a long-term CD an almost perfect savings instrument. This is especially true if the inflation rate when you cash in your CD is much lower than when you took it out, giving an extra boost to the buying power of your earnings.

History teaches us that rates are highest during inflationary periods. Still, you don’t want to lock in a rate that may go even higher if inflation continues. Rates have been on the rise, but for how long?

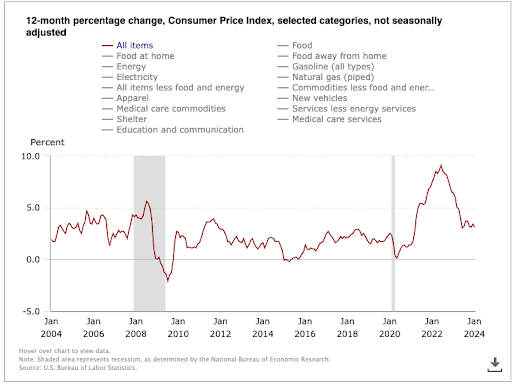

This chart from the U.S. Bureau of Labor Statistics shows that the Consumer Price Index (CPI) inflation measure declined from February through July of last year and has been relatively steady since that time.

Source: U.S. Bureau of Labor Statistics

If you believe the CPI will fall further, causing the Fed to pause or even lower its funds rate as it attempts to achieve its goal of 2% inflation, locking in a high-interest long-term rate makes sense, as CD interest rates will more likely than not also decline. If you think the run is not quite over, and inflation may stall or turn around, you may want to stick with short-term CDs, say one, two, or three months, while hoping for even higher rates later in 2024.

The combination of back-to-back recessions and high inflation resulted in rates of 17.52% on three-month CDs in 1981. When inflation rises, long-term CD rates are typically not a good investment.

The COVID-19 pandemic resulted in CD rates below 1%. Low inflation and federal funds rates ranging from 0% to 0.25% have kept rates low because CD interest rates rise with demand for deposits. More recently, however, with inflation and the Fed funds rate both rising, CD rates are up again.

CD rates rise as the federal funds rate rises in response to increasing inflation. Locking in high rates long term can be beneficial if inflation begins to fall. Otherwise, rising inflation can wipe out much of the gains from high-interest-rate CDs.

Currently, short-term CD rates are higher than those on long-term CDs. This is an unusual inverted-rate environment, as banks tend to reward long-term deposits with higher rates. Over the next few years investor expectations of weak growth and slow inflation will continue to feed this trend.

Generally speaking, CD rates rise with inflation. This is not a direct correlation, as the federal funds rate increases in response to inflation, resulting in rising CD rates as banks try to encourage deposits.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.