Routing Number vs. Account Number: Key Differences and Where to Find Them

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

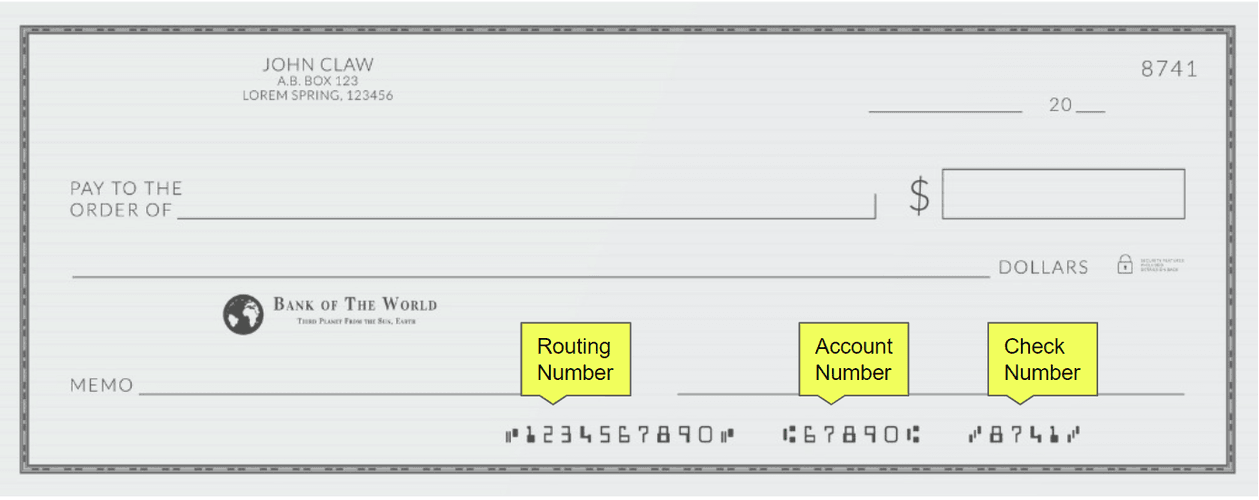

When you execute a financial transaction, you are sending money from one financial address to another. Like a physical address, money needs a set of directions. That’s where routing and account numbers come in. Think of them as two components of a financial address: the routing number specifies the financial institution, and the account number identifies the specific account at that institution.

You need these numbers for financial functions that involve transfers of money. For example, they are necessary for direct deposits, an increasingly common way to pay wages, which makes knowing them and understanding how they differ important.

Source: iStock

A routing number is a nine-digit code used to identify your financial institution. It’s a way for banks to distinguish which financial institution is responsible for payment.

Banks first started using these numbers based on a system set up by the American Bankers Association in 1910 (that’s why they are formally called “ABA routing transit numbers”). If you are trying to perform an electronic transfer, set up a direct deposit, or set up an automatic bill payment, you will need the routing number.

A routing number is the first nine-digit series of numbers. located on the left-hand side of a physical check It identifies the financial institution associated with the payment. Consider the following example:

123456789 : 012345678912 : 1254

In this case the routing number is 123456789, and it corresponds to your bank. It’s telling the institution that processes the payment where it’s coming from. The number serves the same function in the digital world, where payment is made electronically.

Again, the routing number for your checking account will be on the bottom left of the check. It’s located under the check’s “memo” line, where you write the purpose of the check.

It’s the first nine digits in the series of numbers at the bottom and is followed by the account number and then the check number.

Of course, fewer and fewer people use paper checks these days. On a banking app the number can usually be found by logging in and accessing the account information section. It should be clearly labeled.

An account number is the unique code—usually eight to 12 digits—that identifies your banking information. The reason for this number is to set your account apart from the others at the bank. Even though the routing number will show to which bank or other institution to send a transfer or deposit, it’s the account number that makes sure the transfer makes it to your personal account.

The account number is the second series of digits, and it’s scrunched between the routing and check numbers.

123456789 : 012345678912 : 1254

In the same example from above, the 12-digit account number is 012345678912.

While both numbers are necessary for most basic transactions, they denote different things. Routing numbers identify the specific institution at which your account is located. They give financial institutions a way to make transfers between each other.

Account numbers, in contrast, are there to find a specific account at the bank. This number is unique, and it’s assigned to your account when you open it.

The easiest way to manage your routing and account numbers is to keep them somewhere you can access the information when necessary. Write them down and keep the paper or digital document somewhere accessible but safe. These numbers are sensitive banking information that is distinctive to you.

For people who use banking apps, the information will be readily available by logging in. And if you have a checkbook, just look at one of your checks.

Routing and account numbers are essential for most basic financial actions, such as making a transfer of funds or setting up automatic deposits. They specify where money comes from and where it goes. Be sure to keep diligent track of them.

“ABA routing transit number” is the formal name for a routing number. It’s the nine-digit number at the bottom of your check that specifies the financial institution with which the account is affiliated.

When a routing number is wrong, the transaction will be rejected. Why? Because without that number, the institution won’t be able to figure out where to direct the transaction. It’s like having your address correct on a letter but giving a nonexistent state and zip code.

Know that the Internal Revenue Service (IRS), the U.S. tax authority, doesn’t accept responsibility for taxpayer errors. In its eyes, that’s on you.

If you accidentally enter the wrong information on a direct deposit for a tax refund, contact the IRS to correct the information. Assuming the refund hasn’t gone out yet, that should take care of your issue. If it has, the IRS will get an error message and eventually send you a paper check by mail. That’s unless the money somehow found its way to another account, in which case you should contact the bank to recover the funds and have them sent back to the IRS. Once it gets the funds, the IRS will send you a paper check.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.