How Much Social Security Will I Get?

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

If you’re like a lot of people, you probably wonder, how much Social Security will I get when I retire? There is a keen interest in retirement planning in recent years, especially since traditional defined-benefit pension plans have largely disappeared.

While it’s important to learn all you can about how to save and invest for retirement, it’s equally critical to be aware of what your Social Security benefit will be. Social Security benefits will likely play a key role in your retirement, as they will represent a big portion of retirement income for the vast majority of Americans.

Calculating your Social Security benefit payment is an inexact science. This is because there are many factors that go into the benefit calculation performed by the Social Security Administration. That’s no easy job since it incorporates earnings from throughout your lifetime, then attempts to make estimates about future earnings.

But you can use the calculator in this article to get a rough idea of what you can expect that benefit to be.

Your date of birth is a critical piece of information because it determines both when you can receive benefits and your full retirement age (FRA).

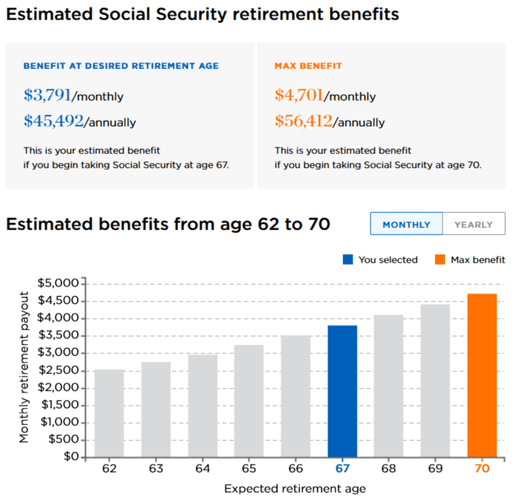

You are eligible to begin taking benefits at any year of your choice between the ages of 62 and 70. While 62 is the earliest you can begin taking benefits, that amount will be significantly reduced from your FRA. Conversely, you’ll earn a higher benefit for each year you delay collecting your benefit.

Age 70 is generally considered to be the maximum age to begin collecting benefits since that is the age at which Social Security benefits top out. There is no advantage to waiting past 70 to begin collecting your benefits.

Your Social Security benefit is based primarily on your annual income. While your earnings in each year of your working life do figure into your monthly benefit, your current and future earnings also play a large role. The higher your income now and in the future, the higher your benefit will be.

You will need to estimate this percentage since it is a projection and cannot be known with any precision. Though a figure of 2% or 3% is commonly used, you may want to increase that percentage if you are early in your career and expect a more substantial increase in future earnings.

Using the steps from above, you can use the Social Security calculator to learn how much in benefits you’ll get,

You can simply input the four pieces of information requested, then hit “Calculate” to learn what your benefit may be.

Let’s work an example:

In our example, we’ll use the following information:

After entering the above information, we hit “Calculate” and get the following results:

Note: Please remember this is just an estimate based on current numbers. To get the most accurate estimate, you’ll need to sign up for an account with the Social Security Administration’s plan for retirement webpage. Since Social Security has a record of your actual earnings, it can provide projections of your future benefits with a higher degree of accuracy.

In learning how much Social Security you will get, it’s important to remember that Social Security benefits were never meant to be your only source of retirement income. Distributions from qualified retirement savings plans, such as IRAs and 401(k)s, should be another source, as is a defined-benefit pension, if you are fortunate enough to have one. Other savings and investment accounts are also future sources of income.

If you have substantial balances in these accounts, you can take advantage of various services to help you manage them. For example, Empower will provide advice on how to manage your retirement plans if you have at least $100,000 in assets to manage. Beagle will not only analyze fees within your plans, but it will also help you to complete rollovers of other retirement plans into an IRA, and even to locate old retirement plans.

Still another service, called Retirable, will provide you with a dedicated fiduciary advisor, who will assist you with financial planning and investment strategies, and even develop a monthly retirement income.

Like virtually every other economic or financial activity, Social Security has its own list of unique terms.Some of the most important include the following:

Full retirement age (FRA) is the age at which you can expect to receive what is considered to be your full retirement benefit. If you collect benefits before reaching your FRA, your benefit will be reduced.

This is the benefit you will receive if you begin taking payments at your full retirement age. This is considered to be your base retirement benefit, which will be reduced if you begin collecting earlier, or increased if you delay receiving benefits.

There is a fairly complicated formula to compute this amount, and you can get more details about that formula on the Social Security primary insurance amount webpage.

This is the earliest age at which you are eligible for Social Security retirement benefits. That age is 62. Note that you will receive a reduced benefit if you begin taking payments at that age.

Medicare is the national health insurance program for Americans 65 and older. While it doesn’t figure into calculating your Social Security benefit, it’s commonly deducted from that benefit.

While Social Security benefits are based on each individual’s work history, there is a provision for providing benefits for spouses who did not earn wages during most of their lives.

This is what is referred to as the Social Security spousal benefit. It entitles the non-working spouse to receive a benefit equal to as much as half of the primary wage-earning spouse’s Social Security benefit.

TIME Stamp:Why you need to know how much Social Security you will get

Since most workers are no longer covered by traditional pension plans, Social Security benefits will likely be the only fixed income they will receive. If you have worked for at least 10 years, you’ll most likely be eligible for Social Security benefits in retirement. Those benefits will represent the cornerstone of your retirement income.

You should incorporate an estimate of your Social Security benefit within your overall retirement planning. That will help you to know how much income you will need to generate from your retirement savings plans to provide the type of living you hope to enjoy in your later years.

Note that some state and local government workers are not covered by Social Security. If you or your spouse might be affected by this lack of coverage for all or part of your work life, check with Social Security or with your human resources office at work.

To get a rough idea of how much you receive you can use a Social Security calculator, like the one in this article. Alternatively, the Social Security Administration has its own Social Security Quick Calculator, providing much the same service.

But the most accurate method is to sign up for an online account with the Social Security administration to get an estimate of benefits. That estimate will reflect your benefit based on actual earnings on record with the Social Security Administration. It will also provide you with an estimate of benefits between the ages of 62 and 70.

To qualify for full Social Security, you must reach your full retirement age (FRA). But beyond reaching your FRA, you must also earn enough “credits.”

A credit represents a quarter of one year in which you earn at least the minimum required for that year. For example, by earning at least $1,730 in 2024, you'll get one quarter and one credit—and by earning $6,920, you will receive four credits for the four quarters of that year, even if you have not worked for that entire year. (Note that the amount changes each year with inflation adjustments. For 2025, you will need to earn $1,810 to qualify for one credit.)

To meet the minimum requirement for full Social Security qualification, you must earn at least 40 credits over your working life. You will meet that requirement if you have earned at least the minimum income in each of 10 years, since you will be credited for four credits in each year.

Social Security uses a calculation best computed using average indexed monthly earnings. That represents a summary of up to 35 years of your income. If you have worked longer, only the income from your highest 35 earning years will be included in the calculation.

The answer depends on the year you were born. If you were born in 1960, or later, your full retirement age is 67. But if you were born before 1960, your full retirement age will be based on the specific year in which you were born.

According to the Social Security Administration, full retirement age is as follows for those born before 1960:

| Year of birth | Full retirement age |

|---|---|

1943-1954 | 66 |

1955 | 66 and 2 months |

1956 | 66 and 4 months |

1957 | 66 and 6 months |

1958 | 66 and 8 months |

1959 | 66 and 10 months |

1960 and later | 67 |

Note: People born on January 1 of any year refer to the previous year.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.