Best Time to Buy a House in 2024

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

If you're in the market for a new home, you might wonder when it’s the best time to buy. After all, seasonal real estate patterns can affect factors like housing inventory and home prices, making certain times of the year better than others for homebuyers.

Of course, recent economic events have disrupted traditional seasonal trends. Home prices have soared since the pandemic and remain high in many real estate markets. And mortgage rates have shot up amid the Federal Reserve's rate-hiking campaign against inflation. The combination has parked many would-be buyers on the sidelines, waiting for prices and rates to level off.

Still, a recent report from real estate data company ATTOM suggests that seasonality still plays a role in scoring the best deals. Here are the best times to buy a house in 2024.

ATTOM analyzed more than 51 million single-family home and condo sales over the past 12 years (from 2011 to 2022), looking at calendar days with at least 11,000 sales. The only days that didn't reach the threshold were four holidays: Jan. 1, July 4, Nov. 11, and Dec. 25.

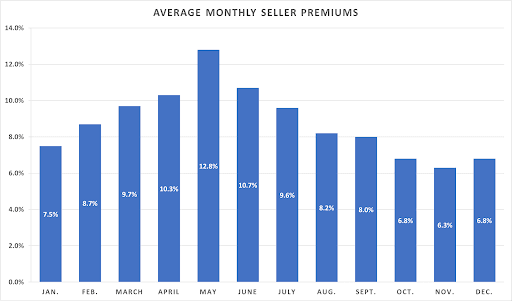

According to ATTOM's report, May is the worst month for finding a deal. After the winter months, there's plenty of pent-up demand and lots of competition from other buyers, which can trigger bidding wars and higher prices. Buyers in May pay the highest average premium—12.8%—above market value.

You’ll find the best deals in November. That's when buyers pay the lowest premium of the year (6.3%). There tends to be less competition from other buyers, many of whom likely wrapped up their home purchases before the start of the school year. And sellers may be more willing to negotiate during this time of year, especially if listings have lingered on the market for an extended period.

Home inventory typically slumps during the fall and winter as shorter days, falling temperatures, and inclement weather make homes look less inviting (and home shopping less fun). At the same time, many families put their selling plans on hold as their kids start school and the busy holiday season sets in.

Homebuyers may have fewer choices this time of year, but the same trends that make November an excellent time to buy—motivated sellers and fewer buyers—also apply to other fall and winter months. These factors can translate to better deals for buyers who are willing to shop during the off-season.

The numbers back it up. According to ATTOM, homes are least likely to sell at a premium during November (6.3%), December (6.8%), October (6.8%), and January (7.5%). The following chart shows the average seller premiums for the entire year:

If you want a lot of choice, spring and early summer are your best bet.

Housing inventory ticks up this time of year for a few reasons. Sellers are eager to get their homes on the market, knowing that many families want to move after one school year ends and before the next one begins. Sellers also know that homes show better as the days grow longer (and warmer), the trees and flowers are in bloom, and the lawn is in its full glory. These months are also a prime time for making home improvements—whether the seller or buyer plans to do the work.

Of course, homes are most likely to sell above market value in the spring and summer. According to ATTOM, buyers pay the highest premiums during May (12.8%), June (10.7%), April (10.3%), March (9.7%), and July (9.6%). Homes also tend to sell the fastest then, as many buyers are ready to pounce with all-cash offers or mortgage pre-approval letters in hand. With more buyers in the market, sellers may receive multiple offers, leading to bidding wars and higher prices.

So, while you might have more homes to choose from in the spring and summer, you'll also have more competition and will likely pay more.

If you're OK with fewer options, you might get a better deal buying a home in November (the month with the best deals), October and December, or January. As an added benefit, you might be able to close faster. There are a few reasons for this, such as:

Seasonality affects housing inventory and prices, but there are other factors to consider when deciding the best time to buy a home. For example, housing market trends vary by city or even by neighborhood. If you're looking for a home in a hot market, you'll likely find lower inventory and higher prices, no matter what time of year you shop. You might still be able to find a bargain, but you may have to rethink your homebuying wish list regarding neighborhood, house condition, or features.

In addition, mortgage rates are a significant consideration right now, and loans have become unaffordable for many would-be buyers. High rates have also decreased purchasing power, meaning many buyers can afford less house on the same budget. At the same time, many would-be sellers are reluctant to leave the comfort of the low mortgage rates they locked in before the Federal Reserve's 10 consecutive rate hikes.

A home is usually the largest single investment a person makes, and paying attention to seasonality is worthwhile. Still, your readiness—financial and otherwise—is the biggest indicator that it's a good time to buy.

Ultimately, the best time to buy a house is when your debt is under control, your credit score is solid, you can afford a down payment, and you're confident you can handle the various costs of homeownership. That way, you can enjoy your home, build equity, and still reach your other financial goals.

If you’re looking for the best deals, you might want to wait until late fall or early winter. That’s the time when buyers typically pay the lowest premiums above market value. However, if you’re after lots of inventory, focus on late spring and early summer in any year. Many homes go on the market as the weather heats up and the school year comes to an end.

The decision to buy now or hold off can be tricky. Buying now means you could get into a home for the first time if you’re a renter—or a bigger house if your family or lifestyle has changed. You could also start building equity right away and avoid potential mortgage rate increases (the Federal Reserve hasn’t ruled out additional rate hikes) down the road. You can’t time the market. So, buying now might make sense if you find a house you like and your finances are in order.

Of course, there are several compelling reasons to delay a home purchase. For example, you should wait if your credit score or finances need work or inventory in your area shows signs of increasing. That way, you might qualify for a more favorable mortgage rate or be better positioned to bargain.

Home prices are uneven across the U.S., and some markets are showing signs of cooling while others are heating up. According to a recent report from the National Association of Realtors (NAR), the median existing-home sales price in May 2023 was $396,100, down 3.1% from a year ago. Home prices dropped in the South and West, while the Northeast and Midwest saw price increases, according to NAR’s press release.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.