Amex Points vs. Chase Points: Which Rewards Currency Rules Them All?

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

American Express Membership Rewards® Points and Chase Ultimate Rewards® are the best—and the most popular—flexible rewards programs among travel enthusiasts, and it's easy to see why. Points from both programs transfer to an array of airline and hotel partners that let users get more value with each redemption, and cardholders can also use their points to book travel through a portal.

Amex points and Chase points also offer other flexible redemption options, such as statement credits and gift cards, albeit at varying rates. Each program also comes with a choice of rewards credit cards that let users earn generous sign-up bonuses and points for each dollar they spend.

At the end of the day, you'll want to compare these programs based on their points values, transfer partners, and redemption options before you focus all your card spending on either one. This in-depth guide does exactly that. Read on to learn how these dynamic programs compare in all the categories that matter most.

When you start to compare Amex points to Chase points, you'll notice fairly quickly that both rewards currencies have several things in common:

As we mentioned, both Amex and Chase offer a selection of credit cards that earn points in their programs. However, there are more American Express credit cards in general, as well as options with no annual fee. For the most part, that's what sets Amex apart from Chase in the point-earning realm. You cannot earn Chase points that transfer directly to its airline and hotel partners without paying an annual fee for the year.

That said, the details get a little murky. You can earn points with a no-annual-fee Chase card and transfer them to partners if you pair your card with one of its travel credit cards. For example, you can earn cash back with the card_name or Chase Freedom Flex, pool your rewards in your card_name or card_name account, then use your points for superior travel redemptions.

With all these details in mind, here are the cards from both programs that earn points that transfer on their own (with no need to pair with another card):

| Welcome offer | Earning rate | Annual fee | |

|---|---|---|---|

bonus_miles_full | 2X points on up to $6,000 spent at U.S. supermarkets per year (then 1X points) 1X points on other purchases Earn 20% more points when you use your card 20 or more times in a billing period Terms Apply. | annual_fees (Rates & Fees) | |

bonus_miles_full | 3X points on up to $6,000 spent at U.S. supermarkets per year (then 1X points) 2X points on gas at U.S. gas stations 1X points on other purchases Earn 50% more points when you use your card 30 or more times in a billing period Terms Apply. | annual_fees (Rates & Fees) | |

bonus_miles_full | 3X points at restaurants, including takeout and delivery in the U.S. 3X points on transit 3X points on travel 1X points on other purchases Terms Apply. | annual_fees | |

bonus_miles_full | 2X points on up to $50,000 in purchases per year 1X points on other purchases Terms Apply. | annual_fees (Rates & Fees) | |

bonus_miles_full | 4X points at restaurants worldwide 4X points on up to $25,000 spent at U.S. supermarkets each year 3X points on flights booked with airlines or through AmexTravel.com 1X points on other purchases Terms Apply. | annual_fees (Rates & Fees) | |

bonus_miles_full | 4X points on up to $150,000 in combined spending in two top business spending categories per billing cycle each year 1X points on other purchases Terms Apply. | annual_fees (Rates & Fees) | |

bonus_miles_full | 5X points on up to $500,000 spent on airfare booked with airlines and flights and prepaid hotels booked through American Express Travel (per calendar year) 2X points on other eligible travel booked through American Express Travel 1X points on all other purchases Terms Apply. | annual_fees (Rates & Fees) | |

bonus_miles_full | 5X points on flights and prepaid hotels booked through AmexTravel.com 1.5X points on purchases in key business categories 1.5X points on purchases of $5,000 or more (on up to $2 million of these purchases per calendar year) 1X points on all other purchases Terms Apply. | annual_fees (Rates & Fees) |

Chase Ultimate Rewards credit cards

| Welcome offer | Earning rate | Annual fee | |

|---|---|---|---|

bonus_miles_full | 5X points on travel through Chase Ultimate Rewards® excluding hotel purchases that qualify for the $50 Annual Ultimate Rewards Hotel Credit 5X points on Lyft Rides through March 31, 2025 3X points on dining (including eligible delivery and takeout), select streaming services and online grocery purchases (excluding Walmart, Target and wholesale clubs) 2X points on other travel purchases 1X points on all other purchases | annual_fees | |

bonus_miles_full | 10X points on Chase Dining purchases, hotel stays and car rentals (after the first $300 is spent on travel purchases annually) through Chase Ultimate Rewards® 10X points on Lyft purchases through March 31, 2025 5X points on airfare booked through Chase Ultimate Rewards 3X points on other travel and dining purchases 1X points on all other purchases | annual_fees | |

bonus_miles_full | 3X points on up to $150,000 in spending in eligible business categories each account anniversary year (then 1X points) 1X points on all other purchases | annual_fees |

Pro Tip: Not all Amex credit cards earn Membership Rewards points, just as not all Chase cards earn transferable points. Make sure you know which cards offer these rewards before you apply.

Generally speaking, both Amex points and Chase points can be worth approximately 2 cents each when redeemed for travel with transfer partners. Of course, you can get outsized value in specific cases. If you are able to transfer points to an airline partner for an international flight in a Business or First class cabin, for example, it's not uncommon to get 3 to 5 cents per point in value or even more.

At the moment, Amex Membership Rewards has 20 transfer partners and Chase has 14 transfer partners. Here's a rundown of the transfer partners of both of these programs, plus their respective transfer ratios.

Both Amex points and Chase points can be used to book travel through their respective travel portals, yet Chase comes out ahead in this category for more reasons than one.

That's because the three Chase cards offer 25% to 50% more value for points when you redeem them for travel bookings through Chase. In fact, the card_name gives you 50% more value when you redeem for airfare, hotels, rental cars and more, and the card_name and card_name give you 25% more value.

As you can see in the screenshot below from my card_name account, a hotel booking at the Park Hyatt Chicago that would cost $661 including taxes through Chase would only set you back 44,024 points.

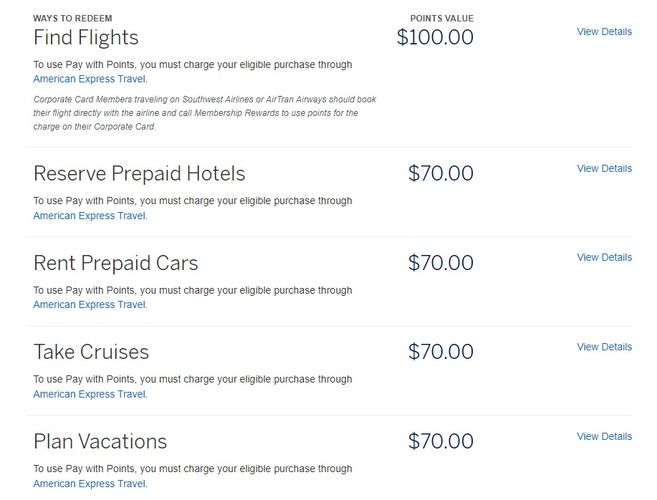

On the flipside, Amex points are worth one cent each when redeemed for airfare through AmexTravel.com. However, you'll only get 0.7 cents per point in value for hotels, cruises and rental cars.

Both Chase and American Express have their own travel portals that let you book travel directly with points. Both portals are similar in that they let you book travel with points, cash, or a combination of the two.

The Amex travel portal lets you seamlessly book airfare, hotels, vacation packages, rental cars, and cruises using your points. We already noted how you'll get one cent per point in travel if you redeem your Amex points for airfare, but that you'll only get around 0.7 cents per point in value for options like cruises, hotels and rental cars.

American Express also has the Fine Hotels + Resorts program that's exclusively for Amex Platinum cardmembers. This program lets you use points, cash or a combination of the two to book exclusive, luxury properties that come with added perks such as free breakfast and room upgrades (based on availability).

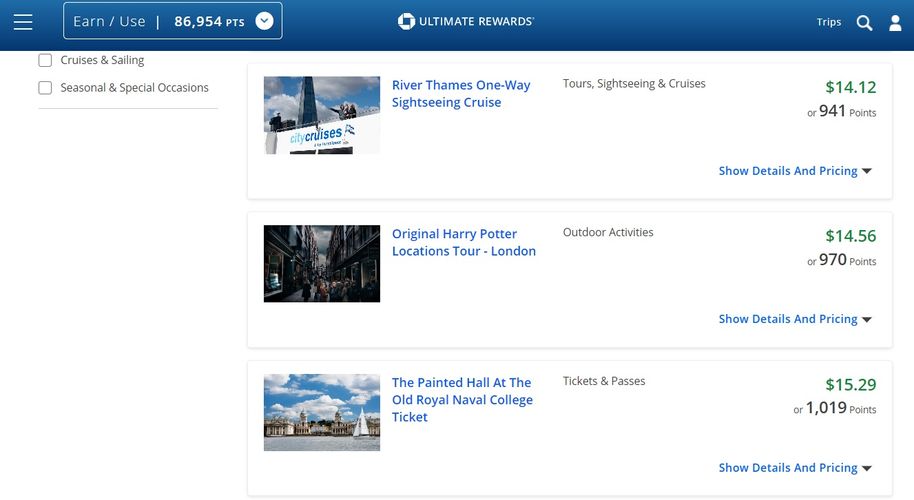

The Chase travel portal works similarly to the Amex portal, except you can get 25% to 50% more value for your points depending on which Chase travel credit card account you are using. This portal lets you book flights, hotels, cruises, rental cars, as well as "activities." The activities you can book are almost entirely excursions, but you can also use points to book airport transfers and other miscellaneous items related to travel.

In London, for example, the activities tab through Chase lets you book excursions such as a River Thames sightseeing cruise or an original Harry Potter tour.

While these options may not be as valuable as point transfers to airlines, I really like the fact you can score low-cost tours and day trips with points, and still get 25% to 50% more value for booking with rewards.

Also note that Chase has the Luxury Hotel and Resort Collection, which offers premium hotel redemptions with upgrades such as free breakfast, early check-in, and more. This collection is available to Chase cardholders with a wider range of card options, including the Chase Sapphire Reserve® and several United Airlines credit cards.

Chase lets you cash in points for purchases at Apple at a rate of one cent per point, and some Chase cards let you pay with points at Amazon.com or using PayPal.com. Both of these options will only net you 0.8 cents per point.

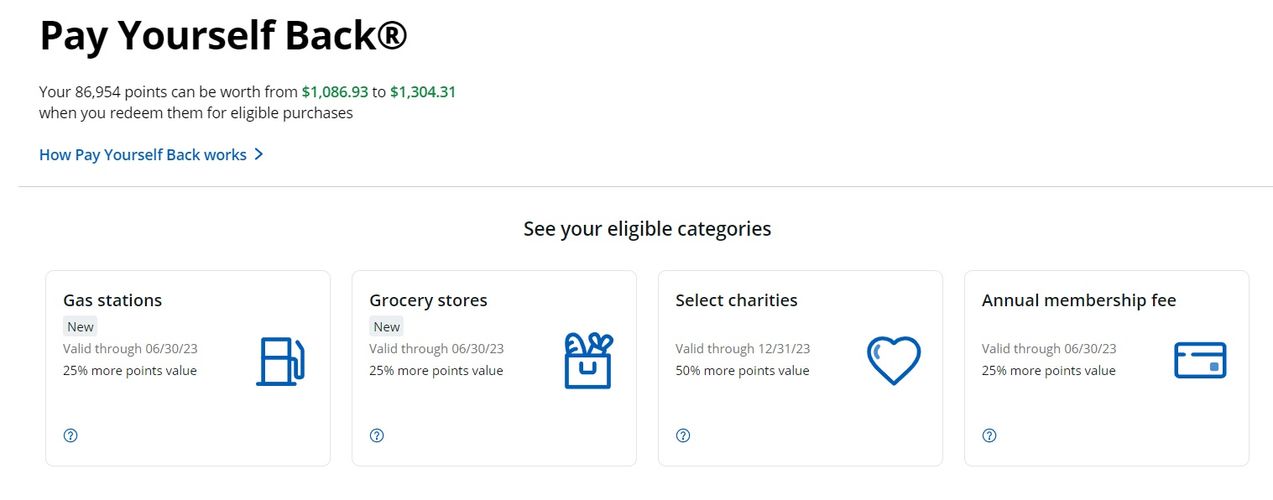

That said, Chase is still offering slightly better value when you redeem points to cover certain types of purchases through its Pay Yourself Back program. However, it's worth noting that this program is tweaked all the time, and that options depend on the card you have.

As an example, the current Chase Pay Yourself Back promotion for the card_name® gives you 25% to 50% more value for your points when you redeem them to cover gas station purchases, grocery store purchases, the card's annual fee, and eligible charitable donations.

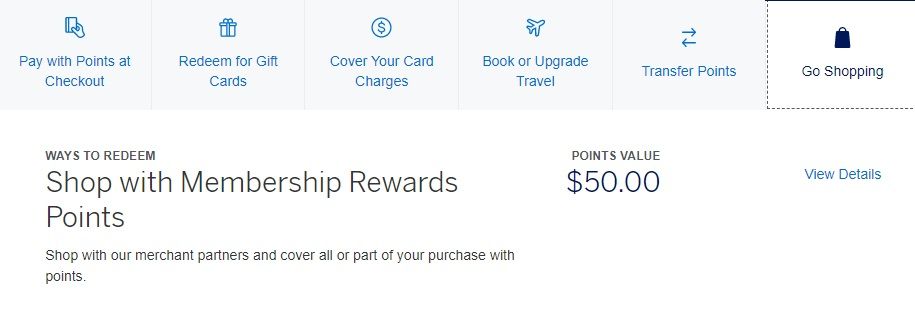

If you want to shop with Amex points, on the other hand, you'll get 0.5 cents per point in value. In this scenario, you would be better off making the purchases you want with your card, then redeeming for statement credits instead. While you won't get a lot more value redeeming for statement credits (as you'll see below), it's better than half a cent per point.

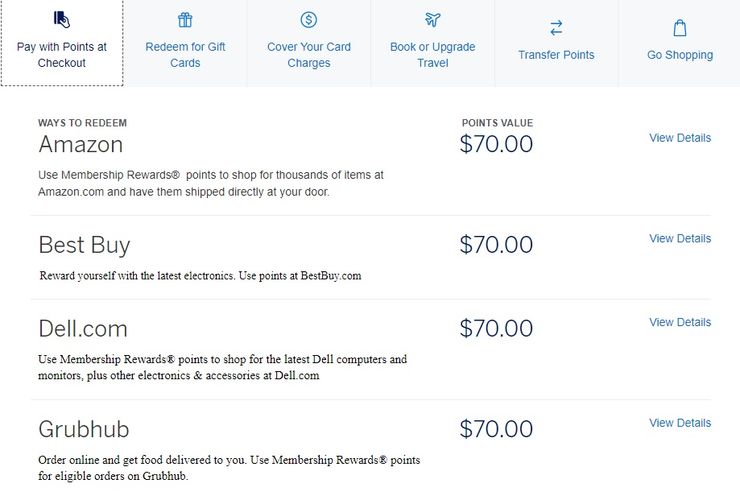

Of course, Amex also lets you "pay with points at checkout" at select retailers. This option will net you 0.7 cents per point at stores like Amazon and Best Buy.

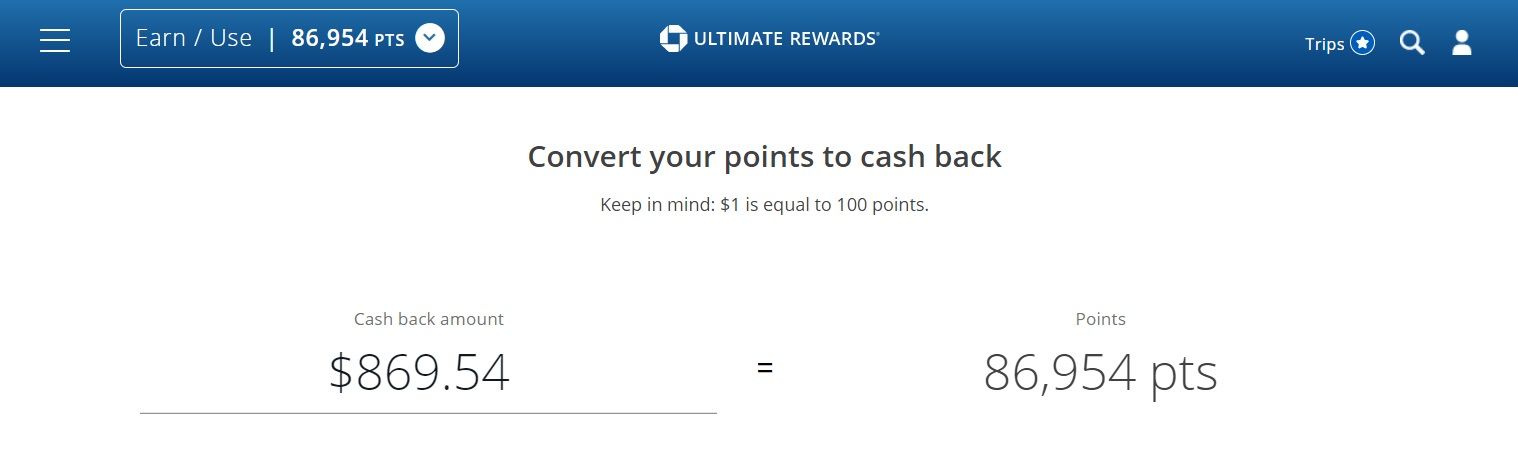

Both programs also let you redeem points for statement credits or cash back. Again, Chase Ultimate Rewards comes out ahead in this category. As you can see in the screenshot below, you can redeem Chase points for cash back at a rate of one cent per point.

Not only does Chase let you redeem for a statement credit to your account at a rate of one cent per point, but you can have the money deposited into a Chase checking or savings account if you have one.

Pro Tip: Since you only get 0.8 cents per point for Amazon and PayPal purchases with Chase cards that offer this option, you would be better off paying for the purchase with your card then just redeeming for a statement credit to cover it at a rate of one cent per point.

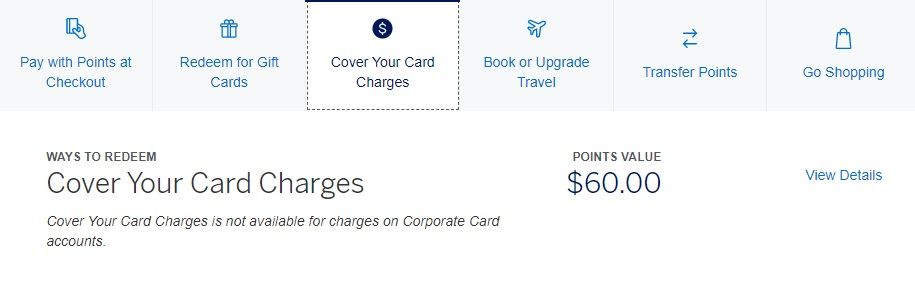

In the meantime, the American Express Membership Rewards program only gives you 0.6 cents per point when you redeem rewards to cover charges to your account. Further, you can't get actual cash back sent to you with Amex points.

Cashing in your points for gift cards isn't always the best option, but it can be a good way to use up extra rewards or get value from your points when you don't have a trip coming up.

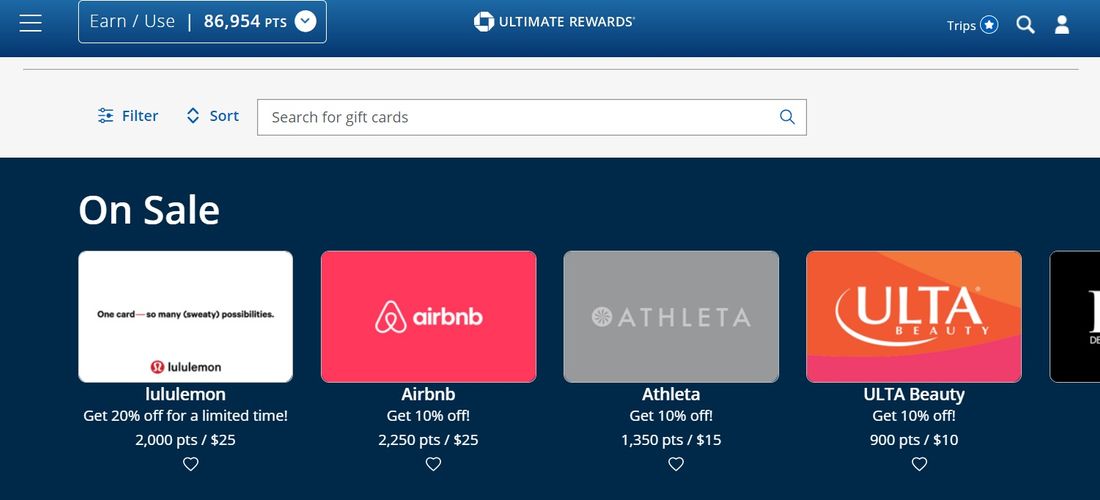

Note that, in this realm, redeeming Chase points for gift cards is typically (but not always) a better deal. That's because Chase gift cards are offered at a rate of one cent per point or better. Chase frequently has "gift card sales" that let you buy gift cards with points at 10% to 20% off.

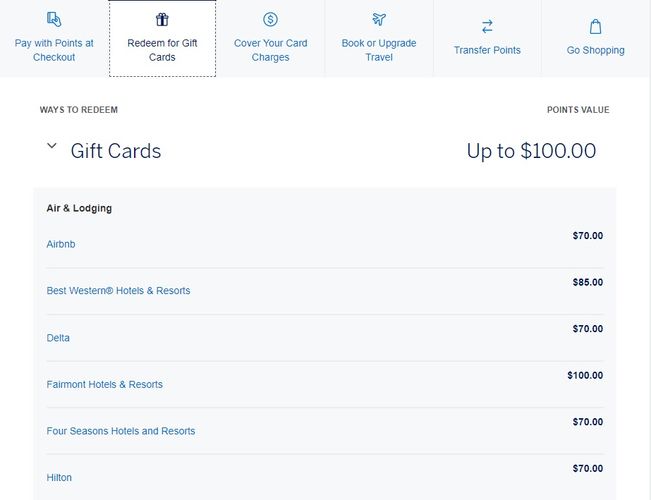

Meanwhile, Amex points are typically worth less than one cent per point when you redeem for gift cards.

At the moment, Amex is showing a value of 0.7 cents per point for gift cards associated with brands like Delta and Hilton. However, many of its restaurant gift cards and some travel options give you the full one cent per point in value or somewhere in between.

American Express automatically pools all your Amex Membership Rewards points in a single account, which is nice when you have several Amex credit cards. You cannot transfer your Amex points to a spouse directly. You can, however, transfer your points to an authorized user’s frequent flyer account.

In other words, your spouse or partner (or other family member) has to be an authorized user on your Amex credit card in order to pool points with them.

On the flipside, Chase lets cardholders pool their own points into the card account of their choosing. That said, remember that point transferability only applies if you have a Chase travel credit card (card_name, card_name, or card_name).

Meanwhile, Chase does let you pool points with members of your household. You used to be able to transfer points to household members after adding their card to your combine points page online. Now you have to call in (with the number on the back of your card) to have new card accounts for household members added.

Here's what Chase has to say online about its points-pooling policy:

"You can move your points, but only to another Chase card with Ultimate Rewards belonging to you or one member of your household or owner of the company, as applicable."

So, which points will leave you better off in the end with Amex or Chase? Let's take a look at their top award redemption options and what points are worth with both programs.

| American Express Membership Rewards | Chase Ultimate Rewards | |

|---|---|---|

Point transfers to partners | 2 cents each (on average); Many (but not all) point transfers are at a 1:1 ratio | 2 cents each (on average); All point transfers are at a 1:1 ratio |

Travel booked through a portal | 1 cent per point for airfare; 0.7 cents per point for car rentals, hotels and other travel | |

Statement credits to your account | 0.6 cents per point | 1 cent per point |

Purchases or shopping | 0.5 cents per point to 0.7 cents per point | 0.8 cents per point to 1 cent per point |

Gift cards | 0.7 cents per point to 1 cent per point | 1 cent per point or better |

As you can see from the chart above, Chase points usually offer a better value but not always. This means that, ultimately, the right rewards program for you boils down to how you actually plan to use your points.

If you still can't decide, you can also consider signing up for travel credit cards that work in both programs. Since many of the transfer partners with Amex and Chase overlap, this can even be a great way to boost your rewards haul for a premium travel redemption.

In the meantime, you may also want to check out other flexible programs associated with Capital One credit cards (Capital One Miles) or the Citi ThankYou Rewards program. By comparing all the top programs, their transfer partners and their travel credit cards, you're bound to find a combination of cards that works for the way you travel.

For rates and fees of the card_name, please visit this URL.

For rates and fees of the card_name, please visit this URL.

For rates and fees of the card_name, please visit this URL.

For rates and fees of the card_name, please visit this URL.

For rates and fees of the card_name, please visit this URL.

For rates and fees of the card_name, please visit this URL.

For rates and fees of the card_name, please visit this URL.

If you transfer your Amex points to an airline partner for a premium redemption, 50,000 points can be worth $1,000. However, 50,000 points are worth $500 if you redeem for airfare through Amex Travel, or worth $350 if you redeem for cruises, hotels, car rentals or other travel options.

The card_name has a lower annua card_name, yet the card_name has a higher rewards rate in bonus categories. At the end of the day, you'll want to compare these cards based on their welcome offers, rewards rates, perks, and features before you decide.

Chase does not offer any no-annual-fee credit cards that earn points that transfer to airline and hotel partners. However, you can pool points earned with a Chase cash back credit card into a Chase travel credit card account for premium travel redemptions.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.